Get Behind the Wheel: Car Financing Morris and GMC Parts in Morris

Get Behind the Wheel: Car Financing Morris and GMC Parts in Morris

Blog Article

Making Best Use Of the Benefits of Cars And Truck Financing Services

When considering the world of car financing services, there exists a myriad of avenues via which one can optimize the benefits acquired from such opportunities. From understanding the varied financing choices offered to strategically navigating the nuances of rate of interest prices and credit ratings, there are essential components that can considerably influence the total advantage obtained from using automobile financing solutions. By delving right into the intricacies of working out problems and terms efficiently, individuals can cultivate a more positive financial landscape when looking for to acquire a vehicle. Therefore, the potential for leveraging these services to their fullest degree comes to be not just a possibility, but a concrete truth waiting to be explored further.

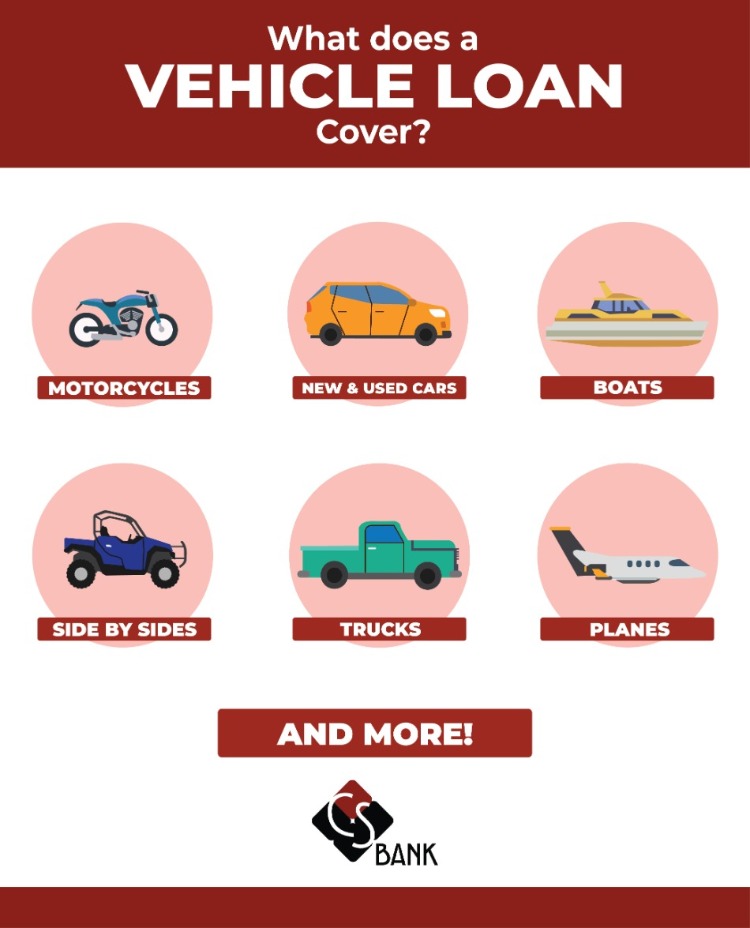

Recognizing Different Auto Funding Alternatives

.jpg)

Tips for Safeguarding a Reduced Rate Of Interest

To protect a reduced rate of interest price on your cars and truck financing, it is essential to purposefully manage your debt score and monetary account. Lenders usually supply lower passion rates to debtors with good credit scores backgrounds.

Comparing deals from numerous lending institutions is additionally crucial. Different lenders may provide varying rate of interest rates, so searching can help you locate one of the most affordable alternative. Bear in mind that the size of the lending term can likewise affect the passion price. Much shorter financing terms often come with lower interest rates however greater monthly repayments. On the various other hand, longer car loan terms might have greater rate of interest yet lower month-to-month repayments. Assess your economic circumstance to identify the most appropriate funding term for you. By carrying out these techniques, you can increase your opportunities of securing a reduced rate of interest on your automobile funding.

Value of Credit Rating in Funding

Understanding the significance of one's credit rating rating is vital in the realm of funding, particularly when looking for finances for major acquisitions such as cars. When it comes to vehicle funding, a good credit rating can open doors to lower interest rates, extra positive lending terms, and greater funding quantities.

Having a great credit rating shows to loan providers that the consumer is accountable, trusted, and most likely to pay off the car loan promptly. This can translate right into significant expense financial savings over the life of the lending. As a result, it is crucial for individuals to routinely check their credit history, resolve any inconsistencies, and job in the direction of boosting it to secure better financing choices for acquiring a vehicle.

Discussing Conditions Properly

Navigating the Extra resources details of car funding involves expertly working out terms to safeguard one of the most desirable bargain. When bargaining car funding terms, it is critical to recognize all elements of the contract thoroughly - Car Financing Morris. Begin by reviewing the rates of interest, financing term, and month-to-month repayments. Compare deals from different lenders to take advantage of competitive rates and terms.

Discussing a reduced interest rate can substantially lower the overall price of the lending, saving you cash in the lengthy run. Remember that the terms and conditions are flexible, so do not be reluctant to review your choices with the lender.

Additionally, consider your spending plan and financial objectives when bargaining terms. Ensure that the month-to-month payments line up with your earnings and expenditures to avoid any monetary pressure. By working out successfully, you can customize the vehicle financing contract to suit your demands and secure an advantageous bargain.

Making Best Use Of Benefits of Automobile Funding Providers

In order to make the most of cars and truck funding solutions, it is vital to purposefully analyze and make use of the available benefits. One vital advantage to make the most of is the opportunity to protect a competitive rates of interest. By investigating and comparing rate of interest rates offered by different loan providers, customers can potentially conserve a considerable amount of money over the life of the financing.

Furthermore, debtors need to make the most of any type of rewards or advertising deals offered by funding business. These may consist of cashback benefits, discounted prices for automatic repayments, or special funding offers on particular car designs. Such benefits can help in reducing the general price of borrowing and make the funding procedure more useful.

Furthermore, consumers can maximize the benefits of auto financing services by recognizing and leveraging any available versatility in settlement terms. Car Financing Morris. Tailoring the finance term to align with personal monetary objectives and capacities can bring about a more workable payment timetable

Conclusion

In conclusion, optimizing the benefits of auto funding solutions is critical for getting one of the most favorable terms and conditions. By understanding various funding alternatives, safeguarding a reduced anonymous rates of interest, and preserving a good credit history, individuals can maximize their automobile financing experience. Working out effectively and being proactive in looking for out the very best bargains can cause considerable benefits over time.

From Clicking Here understanding the diverse financing alternatives offered to tactically navigating the nuances of interest prices and credit ratings, there are crucial aspects that can significantly impact the overall advantage gained from making use of cars and truck financing services.To safeguard a reduced rate of interest rate on your cars and truck financing, it is crucial to purposefully manage your credit scores rating and monetary account. By carrying out these strategies, you can raise your possibilities of safeguarding a low passion rate on your auto financing.

When it comes to car funding, a good credit report score can open doors to reduced interest rates, extra beneficial financing terms, and higher finance amounts. By comprehending various financing choices, protecting a reduced interest rate, and preserving an excellent credit history rating, individuals can make the most of their cars and truck financing experience.

Report this page